The emergence of artificial intelligence (AI) has given rise to a troubling new type of fraud that extends digital impersonation beyond just dating platforms and reality TV and into the realm of financial fraud. Fraudsters are increasingly using tools such as ChatGPT and GAN to create deep-fake synthetic identities, which they then use to deceive financial institutions into granting loans, opening accounts, and making transactions. The landscape of financial fraud is changing rapidly, and the rise of Synthetic Identity Fraud is a significant part of this trend. In this post, we'll explore how AI is being used to create deep-fake identities for financial fraud, the impact of synthetic identity fraud on financial institutions, and what the future may hold for this evolving threat.

The Role of AI in Synthetic Identity Fraud

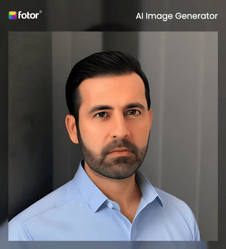

The use of AI has made it easier for fraudsters to create synthetic identities that can be used to deceive financial institutions. With AI, fraudsters can create deep-fake identities that are almost indistinguishable from real ones, complete with a mix of fabricated and stolen profile pictures, biographies, social network profiles, social security numbers, driver's licenses, and other documents. These deep-fake identities can be used to open bank accounts, apply for loans, and carry out financial transactions.

One of the key challenges with deep-fake identities generated by AI is that they can be incredibly difficult to detect. Synthetic identities can have a long history of credit and payment activities, which appear legitimate on the surface but are in fact fabricated. The fraudsters use AI to simulate behaviors that are consistent with a real person's credit profile, such as establishing credit, making payments, and building a credit history over time. Financial institutions are often not able to differentiate between a deep-fake identity and a legitimate one, leading to an increased risk of fraud.

Moreover, the process of creating deep-fake identities using AI has become increasingly sophisticated. Fraudsters can use algorithms to generate large numbers of deep-fake identities quickly and easily. They can also use AI to continually improve the quality of their deep-fake identities, making them even more difficult to detect over time.

Sample deep-fake identity

The Impact of Synthetic Identity Fraud on Financial Institutions

The impact of synthetic identity fraud on financial institutions can be severe. The fraudulent use of deep-fake identities can lead to significant financial losses, reputational damage, and compliance risks.

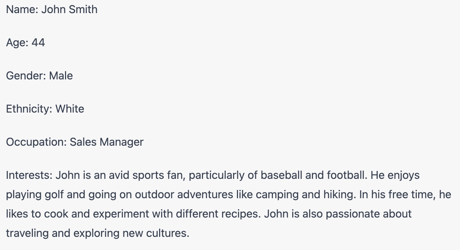

One of the biggest financial impacts of synthetic identity fraud is the loss of revenue resulting from defaulted loans, charge-offs, and other financial losses. Synthetic identity fraud is often used to secure loans or credit lines that are then used for fraudulent purposes, leaving financial institutions holding the bag for the losses. These losses can be significant, particularly when the fraudulent activity is carried out on a large scale. According to the McKinsey Institute, synthetic identity fraud is the fastest-growing type of financial crime in the United States and is also on the rise around the globe, with fraud.com estimating that synthetic identity fraud comprises 85% of all fraud right now.

Synthetic identity fraud can also damage a financial institution's reputation. When it is discovered that a financial institution has been defrauded by synthetic identities, it can erode customer trust in the institution's ability to safeguard their financial information and funds. This can lead to lost business and decreased revenue over time.

Finally, synthetic identity fraud can create compliance risks for financial institutions. Regulations require financial institutions to verify the identity of their customers to prevent fraud, money laundering, and other financial crimes. If a financial institution is found to be non-compliant with these regulations, it can result in significant penalties and fines.

The growth of synthetic identity fraud

The Future of Digital Catfishing and Synthetic Identity Fraud

As AI technology continues to advance, the threat of digital catfishing and synthetic identity fraud is only expected to grow. In the future, fraudsters may use even more sophisticated AI tools to create deep-fake identities that are even harder to detect.

One potential area of concern is the use of AI to create deep-fake biometric data, such as facial recognition or voice prints. With this technology, fraudsters could create deep-fake identities that are not only convincing on paper but also in person, making it even more difficult for financial institutions to detect and prevent fraud.

Another potential area of concern is the use of AI to automate the entire process of synthetic identity creation and fraud, from generating fake data to executing fraudulent transactions. This could make synthetic identity fraud more scalable and more difficult to detect, as fraudsters could quickly create and use hundreds or even thousands of deep-fake identities at once.

To combat these emerging threats, financial institutions will need to continue to invest in fraud detection and prevention technology, including AI-based solutions that can detect patterns and anomalies in data that may indicate synthetic identity fraud. They may also need to work more closely with regulators and law enforcement to share data and intelligence and to develop best practices for combating digital catfishing and synthetic identity fraud.

Fighting back

Fighting this digital catfishing requires a collaborative effort between financial institutions, data providers, government agencies, and law enforcement. By working together, these stakeholders can share information and intelligence, develop best practices, and create a united front against this emerging threat.

One important way that financial institutions can fight back is through information-sharing. By sharing data on known fraudsters and suspicious transactions, financial institutions can create a more comprehensive view of the threat landscape and identify emerging patterns and trends in ways that aren’t possible with information siloes. This can help them better detect fraud before it causes significant financial losses and create faster responses to prevent fraud from happening in the first place.

To facilitate this information-sharing, financial institutions can work with solutions such a FiVerity for a centralized platform for sharing fraud data safely, securely, and in real-time. By analyzing large volumes of data, machine learning algorithms can detect patterns and anomalies that may indicate fraudulent activity. This can help financial institutions better detect and prevent synthetic identity fraud and can also help them quickly respond to emerging threats. By pooling their resources and expertise, institutions can create a more effective defense against digital catfishing and synthetic identity fraud.

In addition to using machine learning for fraud detection and prevention, financial institutions can also use it to improve their customer authentication and identity verification processes. By analyzing customer data and behavior, financial institutions can better distinguish between legitimate and fraudulent customers and can also help them streamline the identity verification process to create a better customer experience.

The increasing sophistication and prevalence of these scams require a united front of individuals, organizations, and governments to combat them effectively. It is crucial to remain vigilant, informed, and take necessary precautions to protect ourselves and our sensitive information from falling into the wrong hands. By collaborating and sharing information, we can work towards developing innovative solutions and strategies to stay ahead of the ever-evolving threat landscape of digital fraud. Together, we can create a safer digital world for everyone.