Protecting consumer data is paramount in the financial services industry, especially when dealing with personally identifiable information (PII). Confidential Computing, which is already used in healthcare and other industries with sensitive data, offers the potential to protect financial institutions with its comprehensive approach to security.

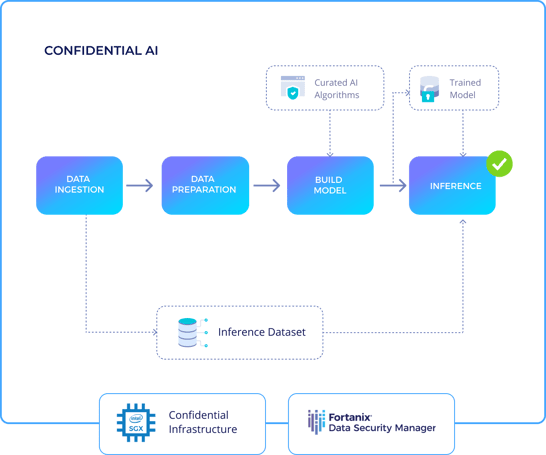

In 2021, Fortanix introduced Confidential AI, allowing data teams to run their AI models within Intel’s Confidential Computing solution – Intel SGX. Running models through this process protects data throughout its lifecycle – in transit, at rest and in use – denying visibility from external entities as well as unapproved internal users.

Source: https://www.fortanix.com/products/confidential-ai/

Together, these technologies provide several advantages including increased security, reduced bias, improved model governance and improved fraud detection.

Security: Query Encrypted Data

By securing data in enclaves, Confidential Computing offers several advantages. Specifically, data teams, including scientists, analysts, and engineers, can query encrypted data without exposing the contents in memory. As a result, teams can be confident that their data is safe from sophisticated breaches and PII leaks.

These enclaves can be used to:

- Securely bring in PII to generate useful model features

- Collaborate across multiple institutions

- Strip PII once this information has been used to train models, allowing data scientists to perform inference and share results without any risk of data leaks.

- Mitigate selection bias since data no longer includes PII.

Improved Model Governance

Eliminating selection bias is not only beneficial for customer growth but also improves model governance. In fraud detection, Confidential AI helps train models that separate good actors from bad, without exposing sensitive data. As a result, fraud analysts still make the final call on fraud reviews but do so without basing their judgment on a customer’s personal data.

While model governance is well regulated for credit approvals, the requirements are much looser for fraud analytics. Biased fraud analysis models provide the same negative result, however; instead of denying an application in the creditworthiness review, it’s simply denied during the fraud check. As a result, Confidential AI is vital to delivering accurate results without compromising model governance policies.

Fraud Fighting

Confidential AI also gives financial institutions a powerful tool in the fight against fraud – the ability to securely share intelligence on fraudsters with other banks. Simply alerting financial institutions to an identified fraudster is a simple and effective tactic, but one that’s rarely used due to data security concerns.

In addition to sending alerts, Confidential Computing enables financial institutions to securely combine data from multiple sources, creating a richer data set that can aid in detecting new fraud patterns. Fraud Analysts and Data Scientists can confidently collaborate by running their models and scripts on Intel SGX enabled resources. This allows organizations to interpret and analyze overwhelming data from multiple fraud solutions to make the most out of previously invested solutions.

Conclusion:

Running AI models through Confidential Computing holds great promise for the financial services industry. Not only does it improve data security, but also helps reduce model bias, improve model governance, and enables collaboration in the fight against fraud.

Download the eBook to learn how FiVerity and Intel are helping banks improve fraud defenses with Confidential Computing.